- Messages

- 11,830

Ch

It’s down 15%. I agree that they’re losing their appetite for the content part of the market.

Charter’s 12 month net income in June was 4.65 Billion dollars. I don’t think that’s razor thin.Two good articles on issues with the future of ESPN and cable in general.

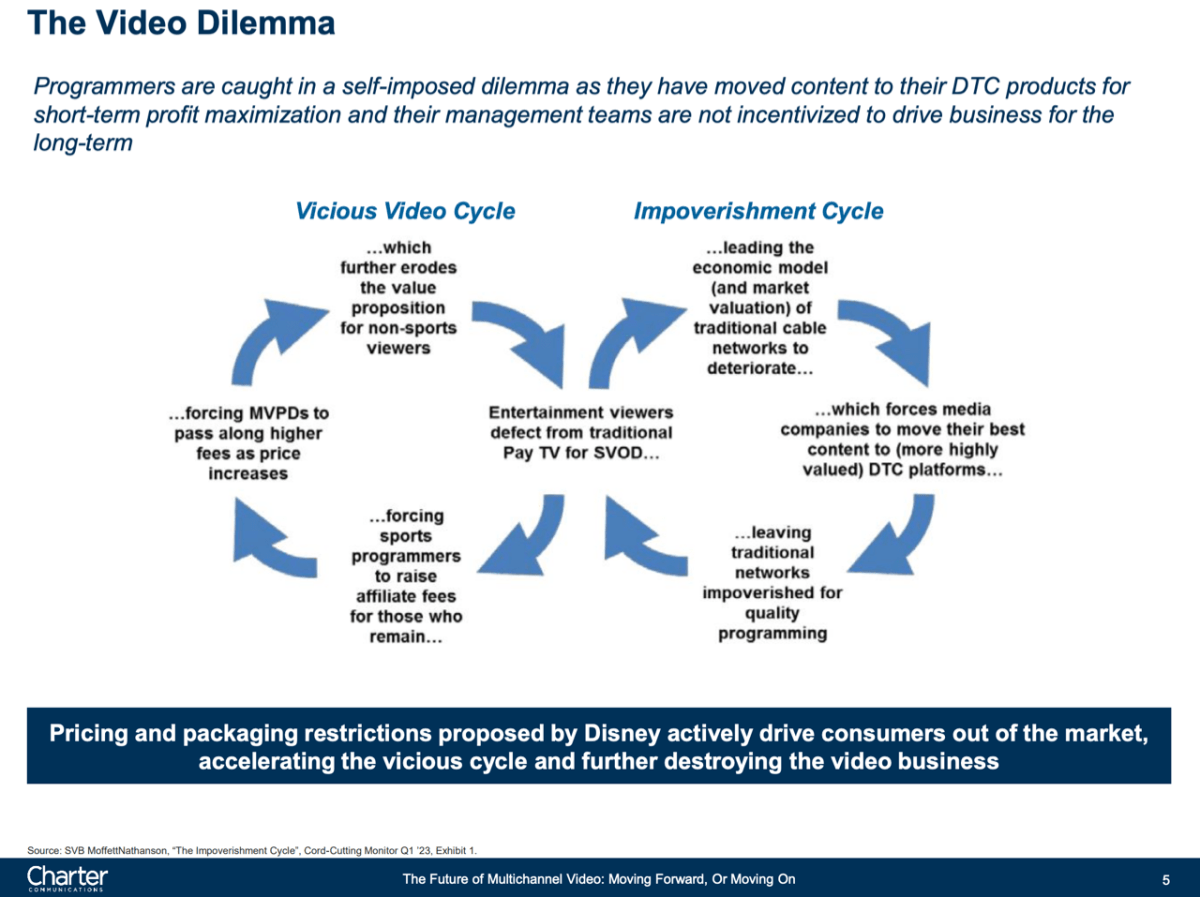

Cable TV companies are starting to understand that the cable TV business isn't really that profitable for them and are starting to make long term strategic decisions based on the idea that they should play to their strengths (which includes potentially exiting the video business all together).

Interesting that with its current impasse with Disney that Charter is simply encouraging its customers to get subscriptions to FUBO or YouTube TV and making it easy for them to do so. Basically Charter just wants to make sure to keep the broadband relationship.

SBJ Media: Why this weekend is so important to Disney, Charter

www.sportsbusinessjournal.com

"Regardless of what a possible deal looks like, the die is cast. Charter has shown the stomach for dropping these channels is stronger than ever. The rate that Charter pays for TV networks -- especially sports -- has become so expensive that the cable operator’s margins are razor thin. Broadband and wireless are a much better business, with much higher margins, for cable operators."

"What’s the worst-case scenario?

If Charter gets out of the video business, and if other cable operators follow suit, media rights could be reset lower, which would have broad implications on team values and player salaries. Leagues and teams still would have media rights deals. But they wouldn’t be the same as they’ve seen over the past three decades, when the cable model benefitted sports leagues and teams more than anything else."

The Rise and Fall of ESPN’s Leverage

Charting ESPN’s rise, including how it build leverage over the cable TV providers, and its ongoing decline, caused by the Internet.stratechery.com

It’s down 15%. I agree that they’re losing their appetite for the content part of the market.