Lotta Booze

Ramblin' Wreck

- Messages

- 779

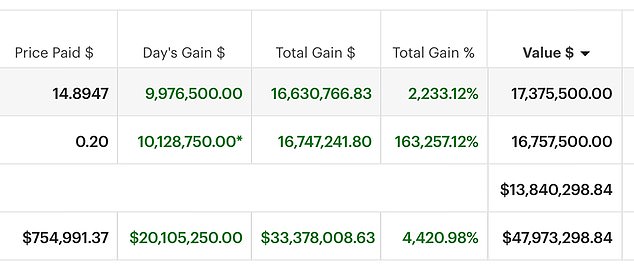

This article quotes "his initial $745,991 investment"

YouTuber Roaring Kitty who disrupted Wall Street is Boston dad

The Youtuber known as 'Roaring Kitty' behind the Wall Street meltdown is a Boston father named Keith Gill, DailyMail.com can reveal.www.dailymail.co.uk

The articles state he began buying in summer of 2019, when the stock was about $5 a share. Indeed, it was around $18 towards the end of this year. 3x $50k doesn't connect the dots. $45m / $50k is a 900-fold increase. That would equate to a $4500 stock.

He put a heck of a lot more in than the original stories implied.

Dude....

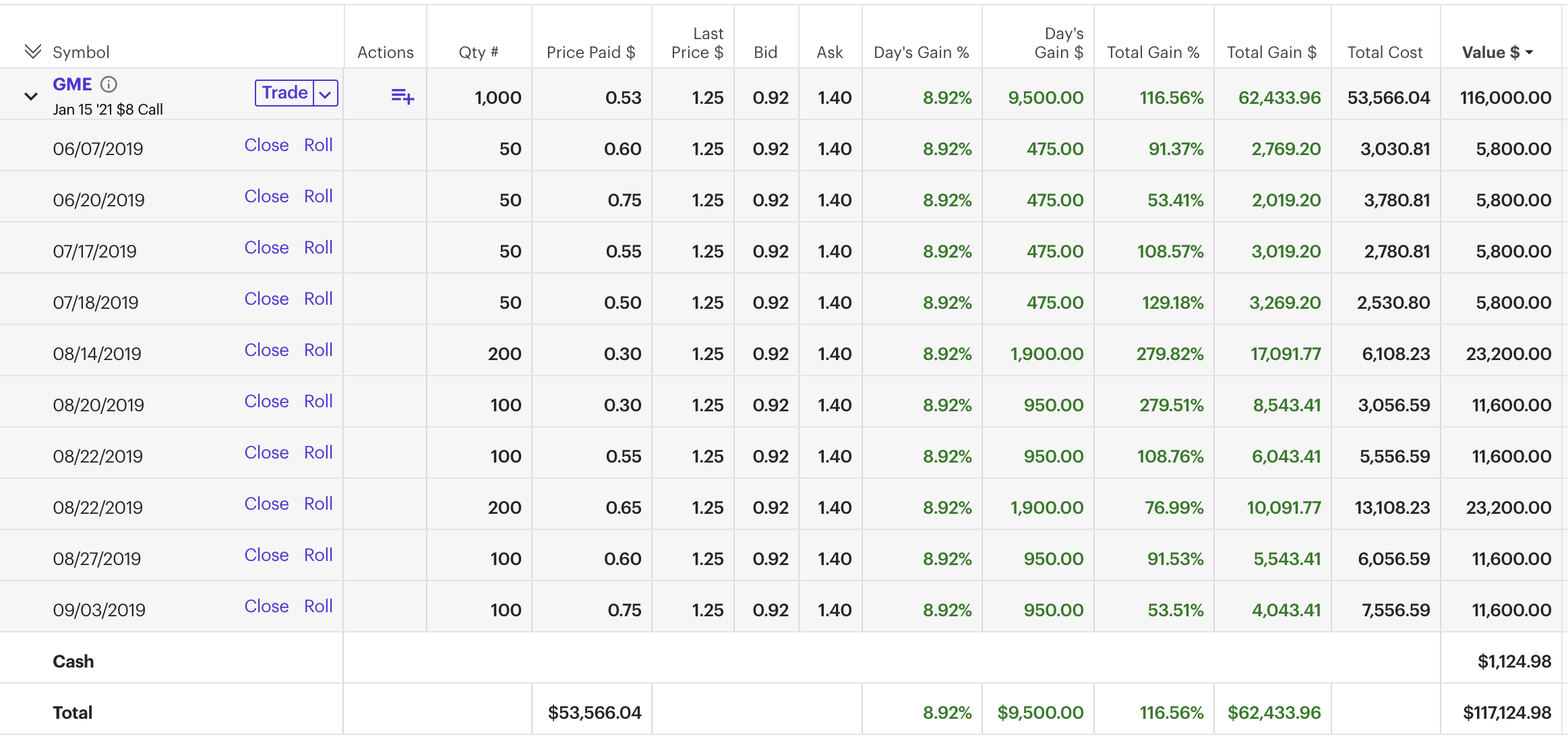

The WSJ article I posted references his $53k initial investment. The guy himself has posted monthly updates on his GME investments. Below is his screenshot from Sept. 2019 with a $53k initial investment. You can go to his profile and track his updates if you want.

He started trading in options contracts which allowed him the higher returns compared to simply buying shares.