Ok. We'll break it down in bite sized chunks

I said, "Trump's tax cut reduced money going into the fund"

Citing a report that says: "lower revenue projections from taxation of Social Security benefits (which provided 8 percent of Part A revenues in 2017) as a result of the tax cut legislation enacted in December 2017"

And your reply was, "I disputed the fact that you said trumps tax cut lead to lower payroll tax revenues - that is demonstrably false."

We're either just talking past each other or you're fighting an argument I'm not making...a strawman. Either way not that important in the grand scheme.

And I'm still not clear on what the point of this little mini-thread is. At first the date of insolvency moving up is used as an example of what a disaster Medicare is and now it sounds like you're arguing that they are inaccurately projecting revenues and they should be higher based off of these "4 million more net new jobs and all those taxes". So the insolvency date should move out further based off of that? Is that what you're trying to say? So Medicare isn't as much of a disaster anymore?

You'll never hear me argue against managing costs running wild. I'm all for it. Which makes it even odder that they'd repeal the IPAB to manage costs if cost is what they are concerned about. But again, I don't think this administration cares about managing costs at all which is why they've increased the deficit. And as others have stated, they want it to implode on itself.

OK, lets break it further down.

When I argued with your assertion that Trump's tax cuts hurt Medicare's solvency, you did indeed respond with the assertion that tax changes hurt...after like 8 lines of spending arguments. So okay, throw out all those - that was the strawman. I am not disputing our spending is out of control.

Back to the tax revenue part - the reason I disagree with you even though you have a link you can cite, is that the link is talking

projections. If you look at

actual tax revenue, payroll tax revenue, etc., it is significantly higher. Like not even a small amount. There are not only higher wages for 150 million Americans on average, there are another 4 million working now, with all that tax revenue.

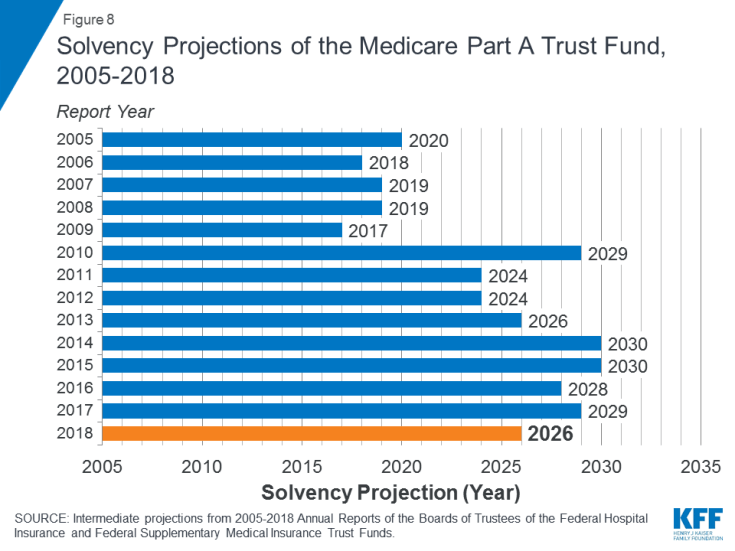

Then you go on to argue I'm disputing Medicare's solvency. No, I'm also not saying that. I'm saying its the worst run Federal Government program of all time. And the data says that. All I'm disputing is that Trump's tax rate cuts hurt the program. That is demonstrably false. Only someone's

projections are worse. The actual revenue is higher. Remember, these same people said the stock market would crash when Trump was elected, that the trade wars would hurt the economy, that his tax rate cut would obliterate tax revenue. All these

projections are false.

Actual payroll tax revenue this fiscal year (ending June 30th) is on pace to be around $3,5 Trillion dollars. It was $3.3 Trillion last year. It was $2.1 Trillion in 2010.

Tax

revenue is not the problem. The problem is that we only charge 1/3rd the actual costs of the program. And every month thousands and thousands and thousands of more people sign up for it as they reach the enrollment age.