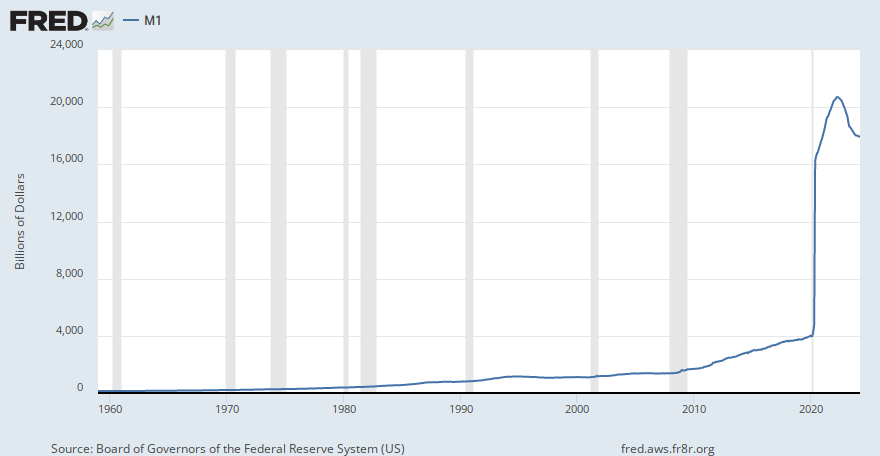

Here is the M1 money supply - read it and weep. Look at the ludicrous amount of money that we printed last year:

View a measure of the most-liquid assets in the U.S. money supply: cash, checking accounts, traveler's checks, demand deposits, and other checkable deposits.

fred.stlouisfed.org

It’s the confluence of multiple things. Free money has banks throwing it around like there’s no tomorrow. Companies are borrowing and investing at cheap interest rates, and homeowners too. The stock market is way overextended and super high, so people who invest are flush with cash. Things got shut down last year and took a long time to restart because people could make more money not working. Our GDP last quarter was a crazy 6%, but would have been 10% if not for the drawdown in inventories. People can’t keep up so they’re charging extra. Nearly every asset category is in hyperinflation. People are moving out of cities now that they know they can work remote and they don’t ha e to put up with that high cost of living and ridiculous shut down rules. They’re calling the move places Zoom Towns and Charleston is one of them. And finally it’s supply. When the market is hot and increasing, nobody wants to sell. Our metro area should have 7,000 homes on the market and we have 900.

We got multiple offers on our home recently and it’s not even listed for sale.

. The latest one was $400,000 higher than what it was appraised for last July.

. So we’re probably going to list it. (Yes we may turn down that silly offer LOLOL). We were going to move in a couple years anyway because our kids will then both be gone. Make money while you can.